Medicare Part D

Basics of Part D

Basics of Medicare Part D

This is the part of Medicare that will help pay for medications that are prescribed by a doctor. The basics of Medicare Part D will start with you understanding that this is provided by private insurance companies and not by Medicare. Medicare never got into the prescription drug market.

Even though Part D is provided by private insurance companies, CMS does oversee it, and each plan must be approved by them before it is offered in someone’s zip code.

There are only two ways that someone can get their prescription drug coverage when they are eligible for Medicare.

1. PDP– Standalone prescription drug plan that someone eligible for Medicare will purchase through a private insurance company approved by CMS. They must be enrolled in Medicare Part A and/or B in order to have a separate prescription drug plan.

2. MAPD– Medicare Advantage plan approved by CMS that offers prescription drug coverage included in the plan offers. They must be enrolled in both Medicare A and B in order to enroll into an MAPD plan.

Part D (Drug) Tiers

Part D plans have a list of covered drugs that are listed on what is called a “formulary” and broken down by “tiers.” The lower the drug appears on the tier, the less the individual will pay out of pocket for that prescribed medication.

There are generally five tiers that an individual’s prescription will fall under with Part D.

1. Preferred Generic: This will be for very common generic medications that are prescribed. You will see these have a small co-pay sometimes of $1 to $3, or it may be even free on the plan.

2. Non-Preferred Generic: This will be for generic medications that the plan did not negotiate a lower cost to be considered a preferred drug under the plan. They are still normally inexpensive but could see a $7 to $13 co-pay under the plan.

3. Preferred Brand: This will be for a brand-name medication that does not currently have a generic equivalent. You will see a co-pay typically around $35 under the plan. A medication like Xarelto would usually fall under this tier.

4. Non-Preferred Brand: This will be for a brand name medication that does not have a generic equivalent and is not preferred by the drug plan. You will see a medication like this anywhere from a $95 co-pay to 50 percent cost-sharing depending on the plan.

5. Specialty Tier: This will be for the most expensive drugs that are typically used to treat severe conditions like cancer or multiple sclerosis. You will see a medication like this with a cost-sharing of around 25 percent. This type of medication will typically have someone fall in the catastrophic coverage phase of Par D.

Medicare Part D- The 4 Stages Of Coverage

We will go over each stage by looking at standalone PDP plans, but the same four stages will be the same regardless of if someone has a Medicare Advantage (MAPD) plan.

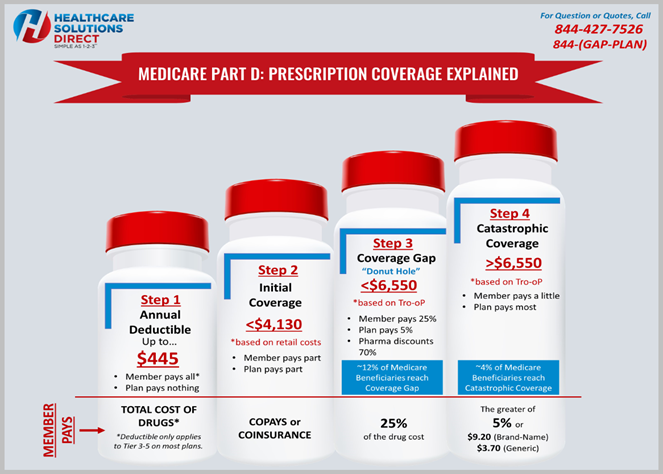

When someone is prescribed medication, they will have four stages: Deductible (if applicable), Initial Coverage, Coverage Gap “Donut Hole”, and Catastrophic Coverage.

The Medicare Part D deductible is set by CMS each year. In 2021, the Medicare Part D deductible that a prescription drug plan can charge cannot be greater than $445.

The deductible that each plan charges can be different, so if someone is taking brand name medications, the deductible can make a difference in what plan is best for them.

A benefit to a lot of Medicare Advantage HMO plans is that they might not carry a deductible on the plan, but the individual may have to pay a little higher co-pay in the Initial Coverage stage.

The Deductible stage for many people may not be applicable, and they might find themselves in Stage 2, the Initial Coverage, right away. This is because the deductible will only apply if the individual is prescribed Tier 3-5 medications or they have their prescriptions filled at a pharmacy that is not within the drug plans preferred in-network pharmacy.

Most individuals that are eligible for Medicare Part D will begin immediately in the Initial Coverage Stage even if the plan does have a deductible.

The individual will begin in this stage if they are not prescribed any tier 3-5 medications, and they are filling their prescriptions at a preferred in-network pharmacy or on a mail-order program with the plan. Most individuals will stay in the Initial Coverage stage all year.

The Part D plan will pay part of each prescription that an individual takes, and the individual will pay the other portion, usually in the form of a set dollar amount co-pay.

The only time that someone would pay a co-insurance instead of a set dollar amount co-pay would be if they were taking a tier 3-5 medication. This would then move them into Stage 3, the Coverage Gap “Donut Hole.

Someone would move into the Stage 3 Coverage Gap once what they paid in co-pays or coinsurance and what the plan paid exceeded $4,130.

The individual would only move into the Coverage Gap if they were prescribed medications that were either a tier 3-5. That would mean they were taking expensive brand name medications that did not have a generic equivalent. Only 10 to 12 percent of individuals on Medicare move into the Stage 3 Coverage Gap.

During this stage, the individual will pay 25 percent of the cost of the medication. Most individuals who are prescribed brand name medication will stay in Stage 3.

The individual would need to have a true out-of-pocket cost (Tro-oP) that exceeds $6,550 in order to move into Stage 4, which is Catastrophic coverage. A brand name medication with a retail cost of around $350 a month or higher will have someone moving into the Stage 3 Coverage Gap “Donut Hole.

Less than 5 percent of individuals on Medicare make it to the Catastrophic Coverage Stage.

You would enter this stage if you were taking a lot of brand name medication or some specialty drugs used to treat a chronic condition like cancer, multiple sclerosis, etc., that might require a tier 5 drug. If someone enters this stage, they will pay 5 percent of the costs of the medication for the rest of that calendar year.

The cost of each medication will be greater than 5 percent, or it will be capped at $9.20 for a brand name or $3.70 for a generic medication.

Top 10 Rx Drugs Filled in the U.S.

1. Atorvastatin Calcium (generic for Lipitor) is used to treat high cholesterol.

2. Levothyroxine (generic for Synthroid) is used to treat hypothyroidism (low thyroid hormone).

3. Lisinopril (generic for Prinivil) is used to treat high blood pressure (hypertension) or congestive heart failure.

4. Omeprazole (generic for Prilosec) is used to treat symptoms of gastroesophageal reflux disease (GERD) and other conditions caused by excess stomach acid.

5. Metformin (generic for Glucophage) is used to improve blood sugar control in people with type 2 diabetes.

6. Amlodipine (generic for Norvasc) is used to treat high blood pressure (hypertension).

7. Simvastatin (generic for Zocor) is used to lower cholesterol and triglycerides (types of fat) in the blood.

8. Hydrocodone/Acetaminophen (generic for Lortab) used to relieve moderate to moderately severe pain

9. Metoprolol ER (generic for Toprol XL) is used to treat angina (chest pain) and hypertension (high blood pressure).

10. Losartan (generic for Cozaar) is used to treat high blood pressure (hypertension).