Medicare Supplements (Medigap)

Basics of Medigap

Basics of Medigap Supplement Plans

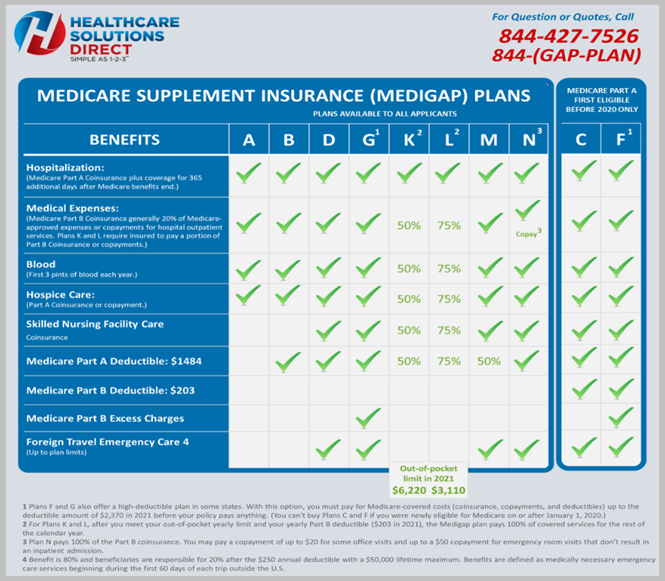

Effective July 1, 1993, the federal government standardized Medigap plans using alphabet letters. The alphabet letter being offered by one company will have identical coverage and benefits as another, so it makes it really easy to shop for a Medigap plan.

Original Medicare Part A and B will be the primary insurance, and they will pay their share of the Medicare-approved amounts for healthcare services that are billed to them by the doctors and hospitals. In turn, what Medicare will do is bill the Medigap Supplement company the remaining bill to pay on behalf of the policy holder.

A Medigap Supplement plan is not the same as a Medicare Advantage plan. A Medicare Advantage plan is just another way to get Part A and B benefits through a private insurance company and not the federal government. A Medigap Supplement plan, on the other hand, is a way to supplement Original Medicare Part A and B benefits from the federal government. You cannot have both a Medigap Supplement plan and a Medicare Advantage plan at the same time.

Medigap Supplement Plans

Those eligible for Medicare Part A prior to January 1st, 2020 are grandfathered into Plan F. They can keep Plan F or Plan C, and they can continue to purchase these plans. CMS did not eliminate these plans. The most comprehensive plans now available for purchase for those newly eligible for Medicare after January 1st, 2020 is Plan G or N.

Medigap Plan F, G, or N

- No Deductibles to pay

- No Coinsurance to pay

- No Co-payments

Plan F will offer the most comprehensive coverage of any of the plans available.

Must have been eligible for Medicare Part A prior to January 1st, 2020, to still be able to purchase the Plan F.

Many would refer to Plan F as the “Full Coverage” plan.

Plan F will cover everything that Medicare A & B approved will not cover. There are no deductibles, no coinsurance, and no co-payments! All that the individual will pay is the monthly premium to the Medigap Supplement company for Plan F.

Note: Medigap Supplement High Deductible Plan F (HDF) is a type of Medigap Supplement plan that covers everything that the traditional Medigap Plan F covers after the individual has met the high deductible on the plan, which is $2,370 in 2021. For those newly eligible for Medicare after January 1st, 2020, the High Deductible Plan G (HDG) is available with the same $2,370 limit.

- Responsible for Part B Deductible ($203 in 2021)

- No Co-insurance

- No Co-payments

Plan G offers the same identical coverage as Plan F except for the individual who is responsible for the small Part B medical deductible ($203 in 2021). Many would refer to Plan G as the “Great Value” or “Go-To-Plan.”

Once the individual met the Part B medical deductible that year, Plan G would be identical to Plan F.

Plan G became a more popular choice than Plan F for those newly eligible to Medicare when the monthly savings was greater than the Part B deductible.

Those looking to reduce their monthly premium would elect to pay the small Part B medical deductible themselves instead of letting the insurance company pay it for them under Plan F.”

- Responsible for Part B Deductible ($203 in 2021)

- $20 Dr. Co-Pay

- $50 ER Copay (Only if emergency room visit does not result in an inpatient admission)

Plan N offers the same identical coverage as Plan G with a couple of minor differences. Many refer to Plan N as the “Now” plan.

This plan has become a very popular plan in recent years because it offers one of the least expensive monthly premiums compared to Plan G and Plan F.

- You are still responsible for the small Part B medical deductible ($203 in 2021), just like Plan G.

- Doctors at their discretion may charge up to a $20 co-pay for an office visit. This co-pay cannot be charged for any preventive care visits, and the Part B medical deductible must have already been met that year.

- There is also a $50 co-pay for a trip to the emergency room that does not result in an inpatient admission to the hospital.

The reason Plan N is called the “Now” plan is that, on average, it will save someone about $30 in monthly premium over Plan G.

Plan N does not cover something called “Excess Charges.” It is something that is extremely rare, almost a non-discussion. In many states, it is not even permitted.

Medigap Is Different in Minnesota, Wisconsin, and Massachusetts

Medigap Supplement plans are still offered in Wisconsin, Minnesota, and Massachusetts, but they do not follow the standard alphabet letters as outlined in the Medigap Supplement charts.

Wisconsin has a “Basic Plan.” You can select some optional riders to cover certain parts of Medicare Part A and B that the individual feels are important to their coverage.

Minnesota has a “Basic Plan”, or “Extended Basic Plan.” With the “Basic Plan” they can also select riders to cover certain parts of Medicare Part A and B. The “Extended Basic” plan will automatically cover some of these additional riders and give some pretty unique features like an extra 20 days of skilled nursing facility care beyond Medicare’s 100 days as well as some additional foreign travel benefits.

Massachusetts has three plans to choose from, which are the “Core Plan”, “Supplement 1 Plan”, or the “1A Plan.”

1. The “Core Plan” will be similar to the Medigap Plan A.

2. The “Supplement 1 Plan” will be similar to the Medigap Plan F.

3. The “1A Plan” will be similar to your Medigap Plan G.

Medigap Enrollment Periods

Someone Medicare eligible can sign up for a Medigap Supplement plan anytime during the year if they have Original Medicare as their primary insurance.

During Open Enrollment Period (OEP) or a Guaranteed Issue (GI), the insurance companies offering the Medigap Supplement plan cannot ask any medical questions. The individual is guaranteed coverage by enrolling in the plan.

If someone is looking to buy a Medigap Supplement plan outside of these two periods, they will need to be what is referred to as Underwritten (UW).

The best time to buy a Medigap Supplement policy is going to be during the 6-month Medigap Open Enrollment Period.

Typically, the individual will get the best prices and choices and are automatically approved for the coverage by virtue of enrolling into that company’s Medigap Supplement plan.

Someone can buy any plan that is offered in their state regardless of their health conditions. If they are eligible for Medicare, this may be the only time that they can purchase a Medigap Supplement plan.

This period starts when the individual is either turning 65 or enrolling for the first time in Medicare Part B. This period cannot be changed when it starts and cannot be duplicated again.

Someone turning 65, regardless of if they are going onto Medicare for the first time or have been on Medicare early for a disability, they can buy any plan that is offered in their state regardless of their health conditions. They will automatically be approved for the coverage.

For those that decided to delay their Part B when they turned 65 and now have a Medicare Special Enrollment Period (SEP), they will also be eligible for a Medigap Open Enrollment Period (OEP).

Since this is the first time enrolling into Medicare Part B, the individual will receive an Open Enrollment Period (OEP) to purchase a Medigap Supplement plan without any medical questions.

For those under a General Enrollment Period (GEP), aka “The Naughty List”, will also get a Medigap Open Enrollment Period (OEP) to purchase a Medigap Supplement plan since this will be the first time they are taking Medicare Part B.

The Medigap Open Enrollment Period (OEP) lasts for a full 12 months. It begins 6 months before the first day of the person’s 65th birth month (or first-time taking Part B) and lasts 6 months after that effective date.

The individual is given a full year to purchase a Medigap Supplement policy without any medical questions or preexisting conditions taken into consideration. They can make any changes to their Medigap Supplement plan during this 12-month period.

The individual is not required to have their Medicare A and B card in place before they sign up for their Medigap Supplement plan. As long as they know that their Part B effective date will be within the next 6 months, they are allowed to enroll in the Medigap Supplement plan.

Important Medigap Supplement Questions

When someone is shopping for the Medigap Supplement plan, it will come down to their zip code.

The Medigap Supplement Plan G will run on average about $125 a month, and the Medigap Supplement Plan N will cost on average about $95 a month.

In an area like Florida where there is a larger population of retirees, and the state uses an issue age rating method, the average cost is about $180 a month for Plan G and $145 a month for Plan N.

If someone is due for a rate increase by their Medigap Supplement company, they can expect to receive a letter from them about a month or two before their policy anniversary date.

The anniversary date can coincide with the individual’s birth month, but it can also be different if they started their policy at a later date. For example, if they purchased a Medigap Supplement plan when they retired or shopped their policy during the calendar year, the effective date might be different from their birth month.

If the policy is with a mutually owned company, they may not see a rate increase because the profits are given back to its members in the form of reduced premiums. If claims are down, they could see their premiums stay the same, or they may see their premium actually go down.

On average, the person can expect to receive about a $7 rate increase every year which is normal.

Since the Medigap Supplement companies do not get any financial incentives from the federal government, the individual will pay them directly for their monthly premium. The monthly premium will not be drafted from their Social Security check like their Part B premium.

The Medigap Supplement companies will require the policyholder to set up the monthly reoccurring draft payment from a checking or savings account, just like, for example, a car loan.

Very few will allow the policyholder to use a credit card for their monthly premium. There are two reasons that they do not allow this.

1. The first reason is that the insurance companies would have to charge a higher premium in order to cover the interest fees on the credit card transactions.

2. The second reason is that credit cards are constantly updated for security purposes, and new cards are mailed to its customer. If the policyholder did not remember to update their credit card with the insurance company, their policy could lapse and find themselves without coverage when they needed it the most.