Original Medicare

Hospital & Doctors Coverage

Original Medicare (Hospital and Medical Coverage)

When Medicare first began, only two parts existed – Part A for hospital services that was free and carried a small annual deductible, and Part B for medical services that charged a small monthly premium. The very first Medicare customers paid a $40 annual deductible for Part A (Hospital) and a $3 per month premium for Part B (Medical).

As of 2021, those costs are now:

- $1,484 for the Part A (Hospital) deductible.

- $148.50 per month or higher depending on your income for Part B (Medical).

Part A covers:

- Inpatient hospital

- Skilled nursing facility

- Home health care.

- Hospice care

Part B covers:

- Doctor visits which include both primary and specialist

- Preventative care

- Outpatient surgeries

- Durable medical equipment

- Expensive treatments like chemotherapy

- Ambulance rides.

Part D covers:

- Oral Medication

- Insulin

- Shingles Vaccine

Understand Medicare Premiums

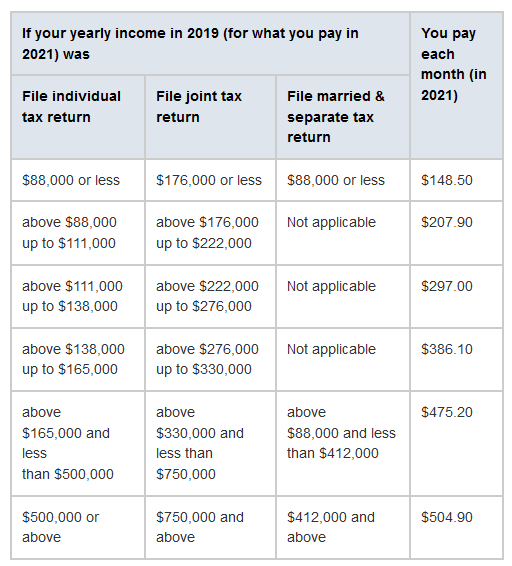

Most people will pay a standard monthly premium for Medicare Part B, which is $148.50 for 2021. However, some will pay more if their income is above a certain amount.

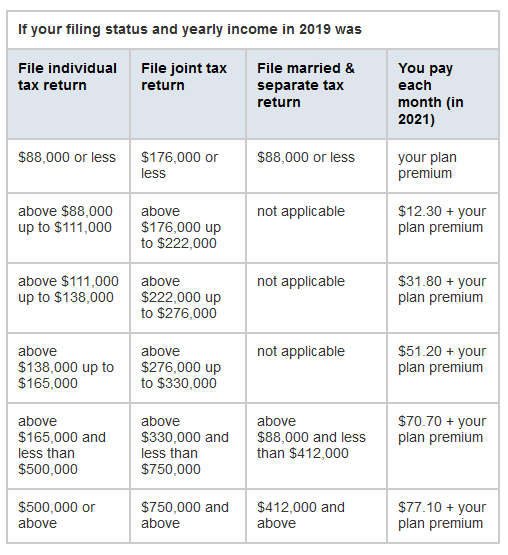

The Part D (Drug) premiums vary depending on your insurance company and your plan’s benefits. However, if your income is above a certain level, you will also pay an additional premium.”

Original Medicare Benefits and Out of Pocket Costs 2021

Before deciding on additional coverage options, you need to know what you will pay as well as where your benefits start and end.

- Medicare taxes for less than 30 quarters, the standard Part A premium is $471 a month.

- Medicare taxes for 30-39 quarters, the standard Part A premium is $259 a month.

There is a deductible under Part A, which is $1,484 in 2021, that will cover you for a 60-day benefit period. This deductible could be required multiple times throughout the year, depending on hospital admittance. Also, you must pay a coinsurance of a few hundred dollars a day after your 60th consecutive day in the hospital. At some point after the 90th day, coverage runs out, and you must pay all costs out of pocket.

Part B has a standard monthly premium of $148.50 for 2021. There is a deductible under Part B for medical expenses, which are $203 a year for 2021. After that is met, Medicare Part B pays 80 percent of your medical costs, and you would be responsible for the other 20 percent. Unfortunately, Medicare Part B does not have a max out-of-pocket cap.